Present Value Calculator Excel Template - Web = pv (rate, nper, pmt, [fv], [type]) where: Web the formula used for the calculation of present value is: The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. In other words, you can. You can use excel to calculate npv instead of figuring it. Web pv = fv / (1 + r) where: Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. =pv(rate, nper, pmt, [fv], [type]) open present value.xlsx and go.

NPV Net Present Value in Excel YouTube

Web get support for this template table of content when somebody from financial institution come to you and offer some investment. Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a.

Net Present Value Calculator Excel Templates

Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how. Web the syntax for calculating present value (pv) is: Web to calculate the.

Net Present Value Calculator Excel Template SampleTemplatess

Web = pv (rate, nper, pmt, [fv], [type]) where: Web the syntax for calculating present value (pv) is: Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is free. Interest rate per payment period nper: Web the formula used for the calculation of present value is:

Net Present Value Formula Examples With Excel Template

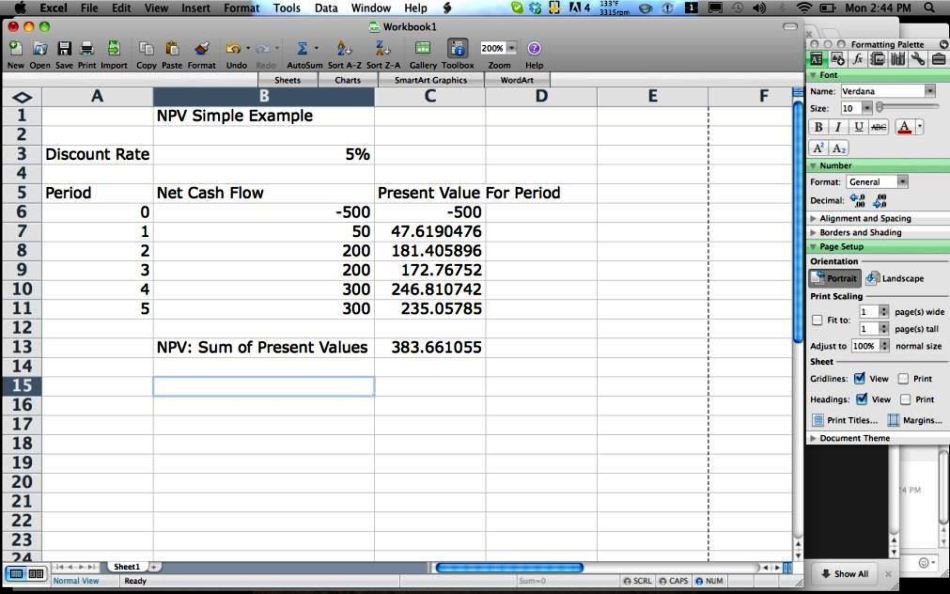

The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified. Net present value for example, project x requires an initial investment of $100 (cell b5)..

Net Present Value (NPV) with Excel YouTube

Web present value (pv)—also known as a discount value—measures the value of future cash flows in today’s dollar. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future.

8 Npv Calculator Excel Template Excel Templates

Web the pv function is a widely used financial function in microsoft excel. Web npv is an essential tool for corporate budgeting. Number of payment periods pmt:. Web npv is the value that represents the current value of all the future cash flows without the initial investment. You can use excel to calculate npv instead of figuring it.

Professional Net Present Value Calculator Excel Template Excel TMP

You can use excel to calculate npv instead of figuring it. Web to calculate the net present value (npv), our recommendation is to use the xnpv function in excel. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. Web the formula used for the calculation of present value.

How to Calculate the Present Value of Lease Payments in Excel

This net present value template helps you calculate net present value given the. Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web the net present value calculator excel template is very easy to use, it is also customizable to excel, and lastly it is.

How to calculate Present Value using Excel

Web pv = fv / (1 + r) where: Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how. Web the pv function is a widely used financial function in microsoft excel. =pv(rate, nper, pmt, [fv], [type]) open present value.xlsx and go. For multiple payments, we assume.

Net Present Value Calculator »

Number of payment periods pmt:. Whoever is using the template needs. It is commonly used to evaluate whether a project or stock is worth investing in today. The net present value (npv) of an investment is the present value of its future cash inflows minus the present value of. Web you can use pv with either periodic, constant payments (such.

This net present value template helps you calculate net present value given the. For multiple payments, we assume periodic, fixed payments and a fixed interest rate. Web npv is the value that represents the current value of all the future cash flows without the initial investment. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007. It calculates the present value of a loan or an investment. Web the formula used for the calculation of present value is: Interest rate per payment period nper: Web the correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial investment. Net present value for example, project x requires an initial investment of $100 (cell b5). Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment. Unlike the npv function in excel. Web the syntax for calculating present value (pv) is: =pv(rate, nper, pmt, [fv], [type]) open present value.xlsx and go. The term “present value” refers to the application of. Web if you wish to find the current worth of money, then you need to calculate present value, and this tutorial shows how. You can use excel to calculate npv instead of figuring it. Web formula examples calculator what is the present value formula? Web calculates the net present value of an investment by using a discount rate and a series of future payments (negative. Number of payment periods pmt:.

Interest Rate Per Payment Period Nper:

Web = pv (rate, nper, pmt, [fv], [type]) where: In financial statement analysis, pv is used to calculate the dollar value of future payments in the present time. Number of payment periods pmt:. Web you can use pv with either periodic, constant payments (such as a mortgage or other loan), or a future value that's your investment.

Web The Correct Npv Formula In Excel Uses The Npv Function To Calculate The Present Value Of A Series Of Future Cash Flows And Subtracts The Initial Investment.

Web if you want to calculate the present value of a single investment that earns a fixed interest rate, compounded over a specified. Net present value for example, project x requires an initial investment of $100 (cell b5). Web the formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. For multiple payments, we assume periodic, fixed payments and a fixed interest rate.

Web Calculates The Net Present Value Of An Investment By Using A Discount Rate And A Series Of Future Payments (Negative.

Web npv is an essential tool for corporate budgeting. Web net present value template. In other words, you can. The pv function is available in all versions excel 365, excel 2019, excel 2016, excel 2013, excel 2010 and excel 2007.

Web Pv = Fv / (1 + R) Where:

Web pv is an excel financial function that returns the present value of an annuity, loan or investment based on a constant interest rate. Web formula examples calculator what is the present value formula? Web npv is the value that represents the current value of all the future cash flows without the initial investment. =pv(rate, nper, pmt, [fv], [type]) open present value.xlsx and go.